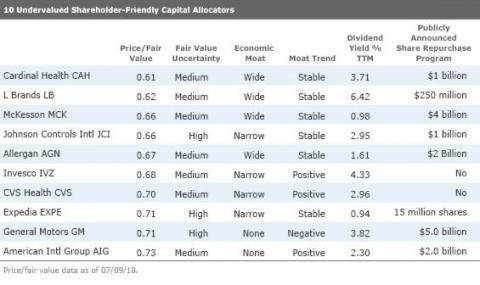

I just ran across this chart from Morningstar that includes eight stocks with share repurchase programs. In general, I’m a fan of buying the stocks of companies that have share repurchase programs, but, you also have to look into the details of how and why they’re doing this, and you also have to understand the business behind each company. For instance, I’ve never heard of LB, so I looked them up, and I have no interest in investing in an apparel company, so immediately I scratch them off.

Other companies like CAH, MCK, and CVS (who suspended their share repurchase program to buy Aetna) are currently beaten down because of the threat that Amazon will enter their business space, so my first thought is that they’re buying back their stock because it’s at a significant discount. But again, you also have to look into their financials to see how they’re buying back their stock — is it from cash flow? Or are they borrowing money to buy their stock, and if so, how long will it take to pay off those loans?