I just started doing some research on the stock of Exxon Mobile (XOM), and these are my notes on their stock. After some introductory notes, all of my other notes are in reverse-chronological order.

Exxon Mobile (XOM) business

This description comes from Yahoo Finance: “Exxon Mobil Corporation explores for and produces crude oil and natural gas in the United States, Canada/South America, Europe, Africa, Asia, and Australia/Oceania. It also manufactures and markets commodity petrochemicals, including olefins, aromatics, polyethylene and polypropylene plastics, and specialty products; and transports and sells crude oil, natural gas, and petroleum products. The company has approximately 35,446 gross and 29,870 net operated wells.”

Definitions

A few notes about oil industry companies:

- Upstream means “exploration and production sector. Companies in this sector have to locate different sites first and then drill into them looking for a consistent reserve of oil. This sector is very exposed to the changes in oil prices since profit is based upon the price of the oil multiplied by the amount of oil discovered.”

- Midstream means “processing and transportation of the oil. This sector is not affected much by the fluctuations in oil prices. Revenue is generated based on how much volume of oil is transported.”

- Downstream means “refining, marketing and distribution. This sector benefits from lower oil prices, as cheaper sourced oil translates into lower expenses and vice versa.”

Those definitions come from this article on Phillips 66.

Introductory notes

A few notes on why I’m looking at Exxon:

- I’ve been looking at good dividend stocks lately

- XOM has a good reputation as a dividend stock

- XOM is down about 20% compared to their 52-week high

- It looks like XOM’s price may have bottomed out in March:

- Oil prices seem to have bottomed out and are coming back up a little

- One of the articles states that they are buying back their own stock (about 20M shares)

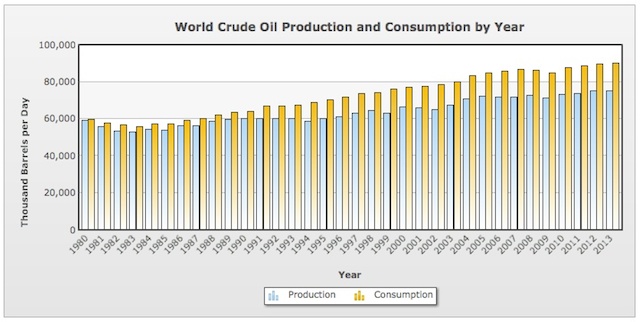

- As shown in the following chart (from this link), the world’s oil consumption is not decreasing:

April 28, 2016

- Oil continues to rise from new money, but production is not slowing (glut)

- Crude high for the year; oil glut now; seen getting better this year into next

January 12, 2016

- This CNBC article has some nice graphs that show the current glut, and also discusses why countries keep pulling oil out of the ground, despite record low prices.

December 20, 2015

- Two developments that may affect XOM (“Two critical developments in the energy market have occurred in the last two weeks. Congress voted on Friday to repeal the 40-year ban on exporting U.S. crude oil, and the deal to lower greenhouse gas emissions that was reached on December 12 in Paris. In my view, both developments would not have a significant effect on Exxon's performance in the next few quarters.”)

November 25 & 26, 2105

- At 488.2 million barrels, the U.S. crude stockpiles is at levels unseen in at least 80 years.

- CNN Money: Saudi Arabia and other Middle East companies will run out of cash in < 5 years

- CNN Money: What it costs to produce a barrel of oil

May 3, 2015

I don’t understand why Chevron is doing this, but these two articles state that Chevron is going to keep producing more oil:

- http://seekingalpha.com/article/3131866-chevron-is-taking-advantage-of-the-pessimism

- http://www.bloomberg.com/news/articles/2015-05-01/chevron-profit-nose-dives-on-oversupplied-crude-s-lower-prices

Aha, it looks like their “upstream earnings” were still $1.56B -- not a shabby number. At first I thought they were losing money in this segment, so I didn’t know why they’d pump more oil, but that’s not the case.

The first article also states that unliked XOM and CVX, ConocoPhillips (COP) has separated their upstream and downstream business. At the moment the vertically-integrated model of XOM and CVX is helping their businesses.

May 2, 2015

This is a good article on MLPs (Master Limited Partnerships ), including these nuggets:

- Rig counts have dropped 50% year-over-year, and capital expenditures for E&P companies are down 40% this year versus 2014.

- The Energy Information Administration projects U.S. crude oil production to increase from an average of 8.7 million barrels a day in 2014 to 9.2 million in 2015, and to stay virtually level at 9.3 million in 2016.

- It expects natural gas production to grow by 5% in 2015 and 1.9% in 2016.

- While a small number of MLPs operate in the E&P (or “upstream”) space, the majority of MLPs are in the “midstream” market, which includes pipelines, rail and truck transportation, and other assets that lie between the producing fields and the end users.

- For the 20 largest MLPs, distribution per unit (DPU) estimates for 2015 have come down 1% since September 2014, and 2016 DPU growth estimates have declined 0.14% - but are still a healthy 12.1%.

- Liquid Transportation & Services MLPs expect their DPU to grow an average of about 15% in 2015.

- Upstream MLPs, on the other hand, have a deteriorating outlook. Before the fourth-quarter earnings announcements, Upstream MLPs expected their DPU to fall an average of 44% in 2015.

May 1, 2015

XOM’s stock is up to $88.85 today.

From this article:

- Considering the crude oil dynamics -- ample supplies and weak demand -- investors do not see an immediate rebound in the sentiment and expect more punishing times ahead.

- With oil prices cooling off, U.S. downstream (refining and marketing) stocks have been notching up healthy gains.

- The business of the downstream players is negatively correlated with crude prices. This is because the companies use oil as an input from which they derive refined petroleum products like gasoline – the prime transportation fuel in the U.S. Hence, lower the oil price, higher will be their profits.

- Thanks to their integrated structures, companies like Exxon Mobil Corp. (XOM), Chevron Corp. (CVX), Royal Dutch Shell plc (RDS.A) are able to withstand plunging oil prices and still protect their top and bottom lines on downstream strength.

- A safer way of playing the sector would be to utilize Master Limited Partnerships (MLPs), which offer considerable returns at significantly lower risk.

- Most MLPs are involved in processing and transportation of energy commodities such as natural gas, crude oil, and refined products, under long-term contracts. As such they have relatively consistent and predictable cash flows, E&P companies, whose profits are highly correlated with commodity prices.

- Given the current weaknesses in petroleum stocks, MLPs are probably the best method of investing in the sector. They also offer liquidity and tax benefits which add to their appeal.

- We suggest Sunoco Logistics Partners L.P. (SXL), Valero Energy Partners L.P. and Regency Energy Partners L.P. (RGP).

From this article:

- Margins at the refining unit surged on tumbling crude prices.

- Their refining business had a profit of $1.7 billion in the first quarter, up $854 million from the same period a year earlier. Its international refining unit saw profit rise nearly fivefold.

- Their diversified model tends to hold up better in a weaker oil market.

- Since the price crash, Exxon said it has driven down costs 20 percent in its U.S. shale oil and gas fields, as producers demand discounts from oilfield services firms.

- Shell, BP, and Total all posted higher than expected profits thanks to their fuel-making units.

Exxon’s April 30, 2015 earnings call

- revenue fell 36% to $67.6B

- profits down 46% (4.9B v 9.1B in Q1 last year)

- profit is 1.17/share, down from 2.10/share Q1

- but analysts estimated 0.80

- cutting capital spending 12% (down to $32-34B)

- increased dividend 6%. bought back stock (20M shares)

- oil prices have dropped from $100/barrel to about 50

- made some drilling projects unprofitable

- ceo said “low prices are going to be with us for a while”

- fundamental changes could be necessary because industry officials don’t expect energy prices to surge anytime soon

- production in Q1 rose 2% (what production?)

- energy flowed from new projects from the U.S. to Papua New Guinea, so the profit plunge was entirely from lower prices.

- Exxon lost money on exploration and production in the U.S. — it earned $1.2 billion from that drilling a year ago

- Exxon is the country’s largest producer of natural gas

- good article: http://www.forbes.com/sites/christopherhelman/2015/04/30/size-matters-exxon-beats-earnings-expectations-by-a-mile/

- upstream business was weak: $2.9B, down from $8B; most in international

- startups helped grow oil and liquid volumes by 6%

- downstream was strong, especially overseas

- “perfect conditions of low oil prices and strong refining margins” (analyst)

- refining and marketing generated 1.7B earnings (1.1B overseas)

- chemicals biz was almost 1B earnings

- cashflow from ops was 8.5B

- had 7.7B in capital spending

- had 3.9B in dividends and buybacks (bought back 20M shares)

- doubling output in a russian project (Sakhalin)

- new Hardian South field in Gulf of Mexico (gas + liquids)

- 300M cubic ft of gas and 3,000 barrels liquid per day (huge)

- shared project in Angola (BP and others)

- Shell, BP, and Total (?) all came in with surprising profits (oil prices were down 50%, but these companies were all still profitable)

- upstream business was weak: $2.9B, down from $8B; most in international

- speculation they may buy BP

Late August, 2015

Oil prices have crashed significantly since I first wrote this article. This image (from here) shows oil prices over the last five years:

Stocks related to XOM

The following stocks are somewhat related to Exxon (XOM) and energy:

- Chevron (CVX)

- Phillips 66 is a downstream oil company

- Chesapeake Energy Corp (CHK)

- Exco Resouces (XCO)

- SandRidge Energy (SD)

- Stone Energy (SGY)

- Halcon Resouces (HK)

Articles related to XOM (and energy)

The following articles are related to XOM, energy, and also dividend-paying stocks:

- http://seekingalpha.com/article/3071666-exxon-mobil-to-outperform-peers-in-2015

- http://seekingalpha.com/article/3119016-there-are-3-words-in-dividend-growth?ifp=0

- http://www.thestreet.com/story/13131415/1/chesapeake-energy-chk-stock-advancing-today-as-oil-prices-rally.html

- http://www.forbes.com/sites/greatspeculations/2015/04/28/five-stocks-that-could-triple-if-boone-pickens-is-right-about-6-natural-gas/

- http://finance.yahoo.com/news/natural-gas-prices-bottomed-164108705.html